Flood Risk Modeling to Support Risk Transfer: Challenges and Opportunities in Data-Scarce Contexts

Photo Credit: Simanta Talukdar / Shutterstock.com

Many economies are suffering the impacts of flooding, from their effect on households and livelihoods to the disruption they cause to businesses and public infrastructure. Due to the number and intensity of flooding events increasing, the ability to accurately measure flood risk has been gaining greater interest across Emerging Market and Developing Economies (EMDEs). However, there is a limited amount of information available to public sector practitioners on what is required to develop models to get both a good understanding of the risk and enable the placement of risk transfer instruments.

This report originated out of discussions within the Crisis and Disaster Risk Financing Team at the World Bank. In addition to the World Bank’s interest in this topic, the Insurance Development Forum (IDF) have been experiencing similar challenges when engaging with client countries looking to develop both risk modelling and risk transfer solutions.

Given the partnership that exists between the two organisations to deliver joint analytical and technical products there was an opportunity to collaborate on the development of this report to outline the challenges and opportunities in developing flood risk modelling to support risk transfer in data-scarce contexts. Doing this enabled the two organisations to make use of their extensive network in the development and insurance sectors, in particular through the London insurance market, to inform the substance of the report.

The report explains what is required to develop a fit-for-purpose flood catastrophe model to support financial decision making. It reviews some new innovations that can be utilised to improve the modelling and monitoring of flood risk and reconciles risk transfer requirements with these latest approaches. Making these insights available to development practitioners and industry professionals is important to avoid models being developed as ‘white elephants’ and not being built to the required standards, using the best international and local science and data.

This report will hopefully help close both the knowledge gaps that exist between the private and public sector and the global protection gap.

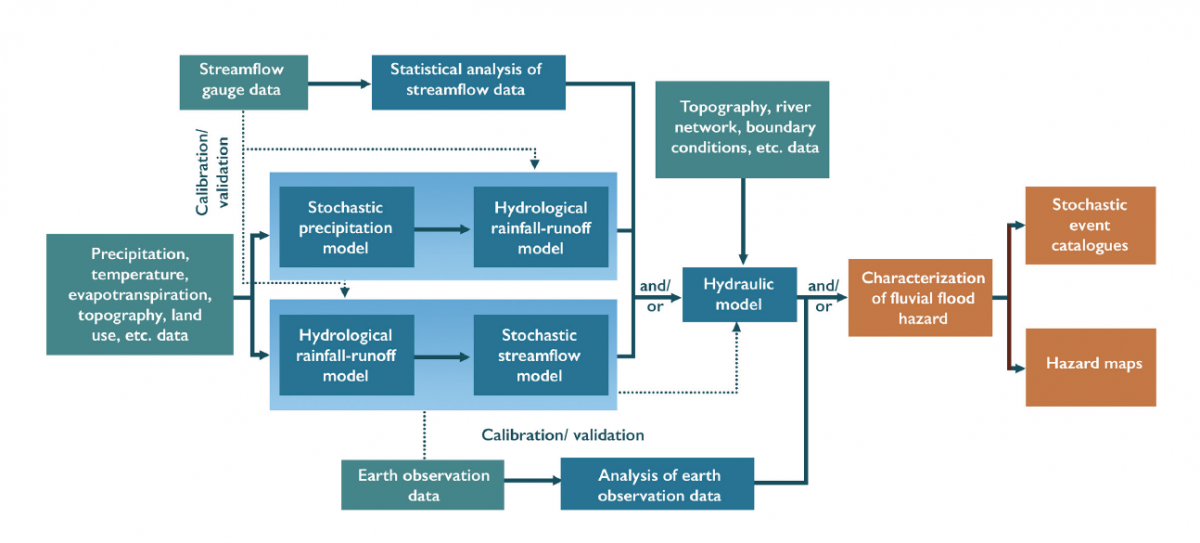

Figure 1. Example approaches to characterise fluvial flood hazard

The key inputs are shown in green, model components in blue, and outputs in orange. The dotted lines show other potential involvement of that box elsewhere in the process.

Source: Flood Risk Modeling to Support Risk Transfer Report

Challenges and requirements for risk transfer

Flood is one of the most frequent and severe hazards that affects people and communities across the world, with around 90 percent of the world’s flood-exposed people living in low- and middle-income countries. The impacts from flooding are also continually increasing due to the combination of climate change, urbanisation and an expanding population living in flood-prone areas.

Reducing the risk from this peril, and therefore the associated impact, can be achieved through comprehensive Flood Risk Management (FRM) Strategies that incorporate risk reduction, risk management and risk financing activities. Accounting for risk transfer and insurance in these FRM strategies is important to increasing the financial resilience of countries and their ability to bounce back from disasters without undermining progress in poverty reduction.

However, to implement good risk transfer solutions requires the development of detailed flood risk models that use detailed data to determine risk-related premiums and robust triggering mechanisms. Historically these models and data have not been available in EMDEs, but recent advances in modelling techniques and data collection mean it is now feasible to develop flood models that can support the placement of risk transfer instruments in these data scarce environments.

This report reviews the processes and challenges in developing these models and proposes guidelines for developing flood risk models and risk monitoring solutions to support disaster risk financing and insurance in data scarce-contexts.

Photo Credit: Wulandari Wulandari/Shutterstock.com

Guidelines for the future

• Risk models must be validated and, calibrated to the local context

• Modelled loss estimates should be used to explore different DRFI (Disaster Risk Financing & Insurance) instruments and decide on a risk layering approach

• Parametric products must be designed in accordance with a suitable monitoring approach that minimizes basis risk (Read full Basis Risk in Disaster Financing for Humanitarian Action report here)

• Local stakeholders should be involved at the outset with high levels of communication and collaboration taking place between all interested parties

Summary

The authors hope that this report adds to the growing knowledge on flood risk modelling globally and can support interested stakeholders when procuring or interacting with flood risk modelling in EMDEs. Improving flood risk modelling for these countries is critical for both ensuring adequate understanding of the risk today and into the future and for assessing options for managing the impact that this peril has on communities.

Click here to read the full report in English and here to read the report in Spanish.