Five Ways COVID-19 Leads to Natural Catastrophe Protection Gaps at the Sovereign Level

Several recent articles have discussed how losses from hurricanes in the United States may be exacerbated by COVID-19 . Many of the articles are written from the perspective of insurers and reinsurers; here, though, we consider the negative impact of such losses on the insured in the context of parametric insurance schemes, which several developing countries have implemented within their risk-financing strategies for disaster response.

1. CONTEXT ALWAYS MATTERS FOR CATASTROPHE LOSSES.

The same hurricane, earthquake, or flood cannot happen twice. Even if it could, the impacts of each event would not be the same because of the ever-changing global, social, and economic contexts in which natural disasters occur. For example, an economy in recession could have lower fuel prices, which could lead to cheaper supply chain costs for recovery or to more unemployed workers who would undertake rebuilding work after a natural disaster, thus minimizing demand surge. If we consider the North American tropical cyclone season of 2017, many Caribbean islands were, unfortunately, affected first by Hurricane Irma, then by Hurricane Maria; thus, the damage caused by Hurricane Maria was different from what would have been the case had only that storm occurred. Catastrophe models can help quantify risk to provide expected losses from natural disasters, but context always matters in determining the real negative impacts of an event. For 2020, that context is COVID-19.

Photo Credit: United Nations. A scene from Les Cayes, Haiti, in the aftermath of Hurricane Matthew, the Category 4 storm which made landfall in the country.

Social distancing systems put in place by governments to help slow the spread of COVID-19 may lead to increased losses by impeding preparation before a storm or recovery after a storm. For example, social distancing requirements may make it difficult for property owners to purchase window coverings or sandbags to mitigate damage before a storm. Further, homeowners or builders may not be able to access properties to commence reconstruction after the storm, thereby leading to increased losses through mold growth and general deterioration.

2. SOVEREIGN DISASTER RISK–FINANCING STRATEGIES ARE NOT THE SAME AS TRADITIONAL INSURANCE.

Sovereign disaster risk–financing strategies, which the World Bank’s Crisis and Disaster Risk Finance Team helps to implement, are often designed to provide short-term liquidity and relief during the period immediately after a disaster. Those financing strategies, including parametric insurance schemes, are designed to ensure rapid payouts to cover emergency response costs such as those for operating shelters, supplying food and medicine, and removing debris.

Emergency response costs are also context dependent. Thus, they are expected to increase as a result of COVID-19, for example, through purchase of personal protective equipment for first responders, for additional shelters to comply with social distancing requirements, and for many of the loss-amplification impacts discussed earlier. This increase is particularly relevant for small island states in the Pacific or the Caribbean where, because of travel restrictions, supplies may be unable to reach certain countries. In April, Tropical Cyclone Harold which was the most powerful storm to hit the South Pacific in years, demonstrated those problems.

3. THE INSURER OR THE INSURED—WHO LOSES IN THE COVID-19 CONTEXT?

Indemnity catastrophe reinsurance layers payout when a natural disaster such as a tropical cyclone causes losses above a predetermined level. COVID-19 has increased the likelihood of such losses occurring. Therefore, reinsurers expect to pay a higher volume of claims in 2020 than they would have paid if the same tropical cyclone had occurred in 2019. Homeowners and business owners, however, are still covered within the context of their insurance policies—that is, their policies will still pay to cover the actual costs to repair their property. Within the context of COVID-19, the indemnity insured are still able to cover all their costs, and the insurer or reinsurer must bear the additional burden.

For parametric schemes, however, in which the insured receive a predetermined fixed amount when an event of an observed intensity or magnitude occurs, it is the insured people or groups who lose. Such policies have been designed to provide an amount of money that will cover the expected losses of an event. Thus, if the real-world context changes sufficiently so that the losses from an event are significantly larger than expected, the insured are now unable to cover the costs. There is a new and context-specific protection gap.

Photo Credit: United Nations. Two girls from Tacloban, the Philippines, stand in front of some of the damage and debris left by the Super Typhoon Yolanda/Haiyan.

4. WE HAVE THE TOOLS TO QUANTIFY THIS PROTECTION GAP.

We have the tools to quantify how large this protection gap could be for a sovereign disaster risk–financing strategy.

Let’s consider a simple hypothetical example to explore how significant such a protection gap can be.

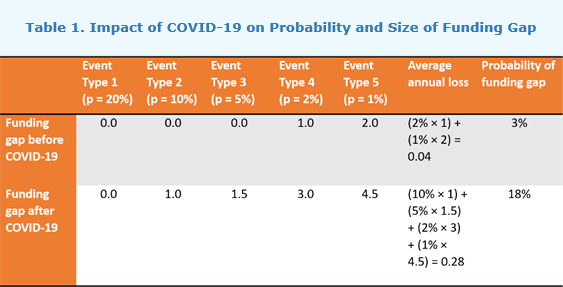

Consider a model for a country that can experience only five types of event and the losses increase with an event magnitude from US$1 to US$5. The country assessed its risk and determined that the probability of needing to access more than US$3 of funding each year was only 3 percent. Therefore, the country implemented a layered approach: US$1 from budget reallocation, US$1 from contingent financing, and US$1 from parametric insurance, which would trigger when an Event Type 3 or greater occurred.

In this simple model, before the loss amplification of COVID-19, the country had a 3 percent chance of suffering a funding gap if either an Event Type 4 or an Event Type 5 occurred, with an average annual funding gap of US$0.04.

Let us assume that the stressor effects of COVID-19 are expected to increase emergency losses in the country by 50 percent. Although the country has a risk-financing strategy in place to cover losses up to US$3, it can access the parametric insurance only for the larger events; the country now has a protection gap for Event Type 2 that did not exist before COVID-19.

See table 1 and figure 1. Overall, although the country’s emergency losses have increased by only 50 percent, the probability that the country will suffer an event that leads to a protection gap has increased by 500 percent, with the annual average funding gap increasing seven times to US$0.28. Critical for this conversation, more than 60 percent of the expected gap is from the smaller, high-frequency Type 2 and Type 3 events, for which the country had previously budgeted and expected to be covered.

5. COVID-19 IS A SYSTEMIC FORM OF BASIS RISK.

The impact of COVID-19 is a systemic form of basis risk for the parametric insured—the difference between the payouts and the needs of the insured—and it may lead to protection gaps for relatively high-frequency events.

Although not represented in our simple model, many countries have also reallocated their budgets to cover other losses caused by COVID-19, and similarly they may have exhausted existing lines of contingent credit to support their economies—thereby further widening the funding gap.

Countries in disaster-prone regions now have less capacity to absorb shocks, which leads to an increased risk of people falling into poverty should they be affected by a tropical cyclone, flood, or other shock in the coming months. COVID-19 may have widened the protection gap even further in some of the most vulnerable developing countries, where the impacts of disaster shocks can undo many years of economic progress.

Photo Credit: United Nations. A scene from Codrington town in Barbuda after the back-to-back, category 5 hurricanes in 2017.

To view this blog in a MailChimp setting, click here.

Disaster Risk Finance | COVID-19 Blog Series

- Five Lessons on Disaster Risk Finance to Inform COVID-19 Crisis Response

- Five Reasons You Should Be Thinking About Compounding Risks Now

- Five Reasons the Global Risk Financing Facility Is Relevant During an Ongoing Pandemic

- Five Ways COVID-19 Leads to Natural Catastrophe Protection Gaps at the Sovereign Level

- Expect the Unexpected: Three Benefits of Rainy Day Funds

- Five Ways the World Bank’s IDA-19 Is Supporting the Poorest Countries in the Time of COVID

- Three Ways That Contingent Policy Financing Contributes to Resilience Building Before, During, and After COVID-19

- Five Reasons to Support SMEs So They Can Build Stronger Resilience to Future Disaster Shocks

- Three Reasons the Public and Private Sectors Are Stronger Together Against Disasters and Crises

- Five Ways Satellite Data Can Help Prepare for the Unexpected

- Four Ways Disaster Risk Finance Strengthens the Effectiveness of Adaptive Social Protection

- Three Ways to Enhance Online Knowledge Exchange During the COVID-19 Pandemic