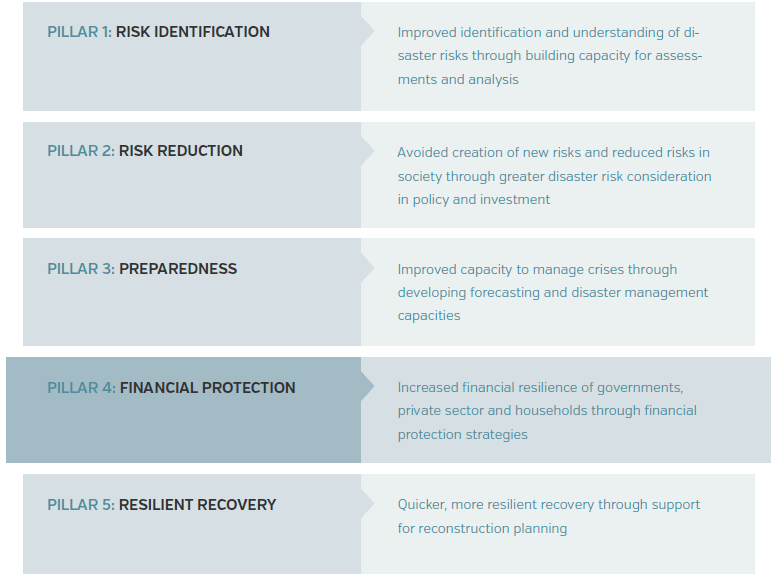

Governments can take steps to reduce the negative financial effects of disasters in a way that protects both people and assets. The World Bank and the Global Facility for Disaster Reduction and Recovery (GFDRR) have developed a framework that guides governments through a practical and comprehensive approach to disaster risk management.

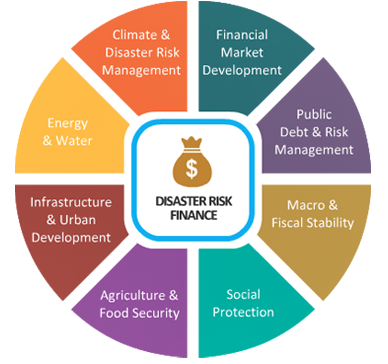

This disaster risk management framework brings together necessary actions for building resilience, including: risk identification; risk reduction; preparedness; financial protection; and planning for disaster recovery. This framework is based on the fundamental principle of empowering citizens and governments to understand their risks and make informed choices about how best to address them.

Financial protection complements risk reduction by helping a government address residual risk, which is either not feasible or not cost effective to mitigate. Absent a sustainable risk financing strategy, a country with an otherwise robust disaster risk management approach can remain highly exposed to financial shocks, either to the government budget or to groups throughout society. Financial protection helps a government manage those shocks without compromising development progress, fiscal stability, and wellbeing. But to sustainably reduce the financial impact of disasters governments should always consider ways to reduce the underlying drivers of this risk.

| More info & Case Studies |

|

Historically, governments mostly addressed the financial effects of natural disasters on an ad-hoc basis following events. Over the past decade, countries are increasingly focusing on proactive planning before a disaster strikes.

Disaster risk financing and insurance aims to increase the resilience of vulnerable countries against the financial impact of disasters. A comprehensive strategy can secure access to post-disaster financing before an event strikes, ensuring rapid, cost-effective liquidity to finance recovery efforts.

Governments normally seek to strengthen the financial resilience of the four different groups identified using appropriate strategies for each. The main beneficiary groups of financial protection include national and local governments; homeowners and small and medium-sized enterprises; farmers; and the poorest.

Sovereign Disaster Risk Financing

|

|

More info & Case Studies |

Property Catastrophe Risk Insurance

|

|

More info & Case Studies |

Agricultural Insurance

|

|

More info & Case Studies |

Disaster-linked Social Protection

|

|

More info & Case Studies |

While a government may not need to pursue all four policy options, disaster risk financing and insurance strategies commonly build on some combination of them. Together, they help the government clarify, reduce, and manage its contingent liabilities to natural disasters. These options do so by using financial risk information to clarify the financial costs and benefits of disaster risk reduction, retention, and transfer; by enabling greater risk transfer to the private sector; and by providing strategies and tools for more responsible management of the remaining costs associated with natural disaster risk.

These interventions are not independent and can be aligned to bring about multiple wins. For example, if a government decides to establish a risk financing pool to retain some amount of agricultural risk—meaning this pool will cover certain pre-determined losses—this same entity could be used to absorb a layer of risk from a cash transfer program that will need to deliver significantly more payouts in case of a disaster. This allows the government to build on the initial investment in developing a risk financing entity for multiple uses.

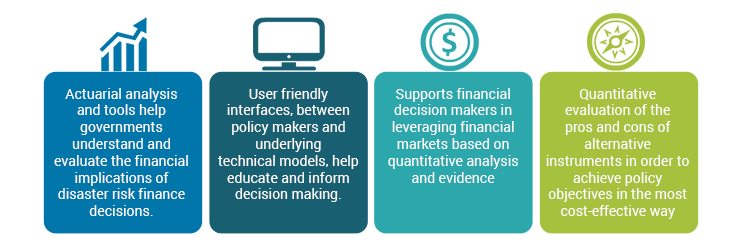

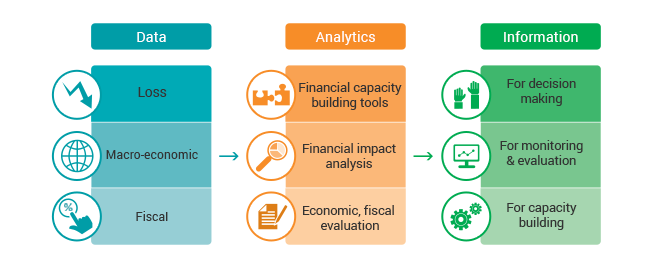

The need for financial risk information and risk analysis to enable progress in disaster risk financing and insurance highlights a fifth, crosscutting policy area: financial disaster risk analytics. Financial risk analytics empowers governments to take more informed decisions by bridging the gap between raw risk data and information that is useful to policy makers. This is a prerequisite for effective use of disaster risk financing strategies and tools.

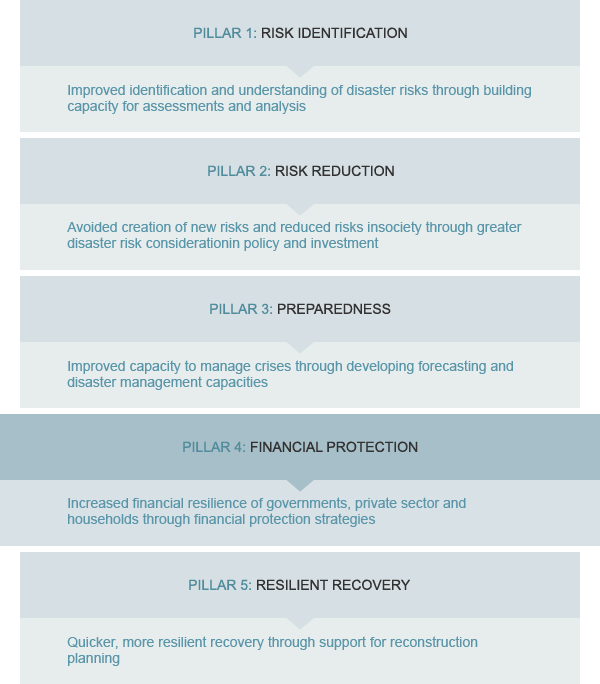

Disaster risk finance sits at the nexus of major policy practices. It connects financial expertise with risk management across many sectors to bring vulnerable countries comprehensive solutions to become more effective risk managers.

Disaster risk financing and insurance strategies are best advanced when integrated into broader strategies in one or more of these fields. Indeed, strong public financial management of disaster risk is particularly important to support the execution of broader disaster risk management strategies. Specifically, disaster risk financing and insurance programs:

Sovereign disaster risk financing benefits governments in many different ways. These include increased transparency and financial discipline, improved risk pricing through market signals, and greater access to capital at the time it is needed.

The World Bank has identified five characteristics that together build financial resilience across society which are improved through disaster risk financing and insurance. These characteristics are not outcomes of one specific project or intervention, but an integrated set of features which support each other towards strengthening financial resilience.

to know more.

to know more. A government can access many different sources of financing for post-disaster response and reconstruction. Some of these options can be mobilized by the government following a disaster, such as budget reallocations or credit. Others need to be established before a disaster hits, for example contingent credit lines or insurance. For some options the government mobilizes money at the sovereign level—including contingency funds—while other options transfer risk to international markets—like the use of reinsurance or catastrophe bonds.

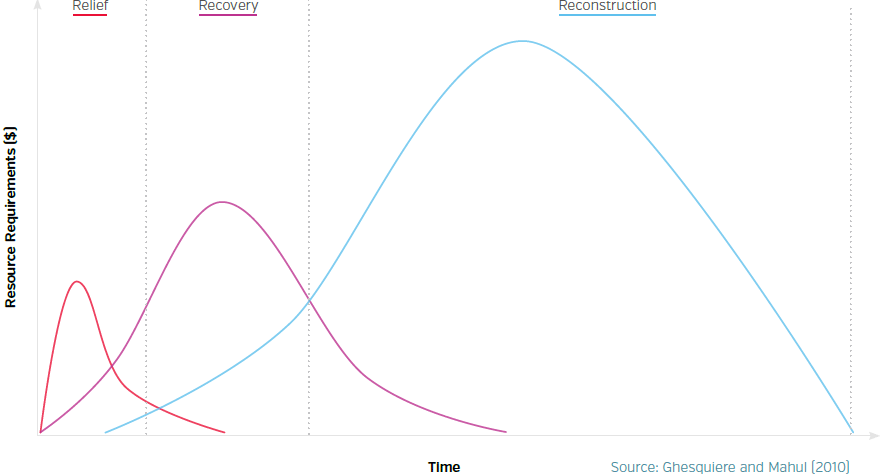

These financing options all differ in terms of their cost of use, amount of money available when disaster hits, and speed of access. Alternative instruments are not inherently better or worse, they simply address different needs. For example, following a disaster a government could issue bonds or raise taxes in order to pay for reconstruction. Such measures provide access to very large sums of money but take a long time to become available. Insurance, on the other hand, can be much more expensive but can help governments manage the volatility of unplanned demands on budgets by spreading the cost of disaster across time. This presents governments with a trade-off in managing costs and risk.

To efficiently address the funding needs arising from disasters, a number of considerations are important.

Understanding the timing of needs is essential. In the aftermath of a major disaster, the government will not require the money needed for the entire reconstruction program at once. While immediate liquidity is crucial to support relief and early recovery operations, the government has more time to mobilize the majority of resources for the reconstruction program. This has clear implications on the design of cost-effective, financial management of disasters.

to know more.

to know more. |

|

More info & Case Studies |

The table below provides an indicative cost multiplier for different financial risk instruments. This multiplier is defined as the ratio between the cost of the financial product (such as the premium of an insurance product, or the expected net present value of a contingent debt facility) and the expected payout over its lifetime. A ratio of two indicates that the overall cost of the financial product is likely to be twice the amount of the expected payout made. These multipliers are only indicative and aim to illustrate the cost comparison of financial products. The speed at which funds can be obtained is also determined by the legal and administrative processes that drive their use (Ghesquiere and Mahul 2010).

| Instruments | Indicative Cost (multiplier) | Disbursement (months) | Amount of funds available |

|---|---|---|---|

| Ex-post financing | |||

| Donor support (humanitarian relief) | 0-1 | 1-6 | Uncertain |

| Donor support (recovery and reconstruction) | 0-2 | 4-9 | Uncertain |

| Budget reallocations | 1-2 | 0-9 | Smal |

| Domestic credit (bond issue) | 1-2 | 3-9 | Medium |

| External credit (for example emergency loans, bond issue) | 1-2 | 3-6 | Large |

| Ex-ante financing | |||

| Budget contingencies | 1-2 | 0-2 | Small |

| Reserves | 1-2 | 0-1 | Small |

| Contingent debt facility (for example CAT DDO) | 1-2 | 0-1 | Medium |

| Parametric insurance | 1.5 and up | 1-2 | Large |

| Alternative Risk Transfer (for example CAT bonds, weather derivatives) | 1.5 and up | 1-2 | Large |

| Traditional (indemnity-based) insurance | 1.5 and up | 2-6 | Large |

How money reaches the ultimate beneficiaries is as important as where it comes from. Having a large amount of money available for disaster response, but being unable to spend it quickly and on the most important priorities, can impede effective disaster response.

Many countries lack the dedicated mechanisms, experience, and expertise to effectively allocate, disburse, and monitor recovery and reconstruction funds after disasters.

Specific post-disaster challenges require strong collaboration between the Ministry of Finance and the public entity tasked with spending the money, such as local governments or public infrastructure maintenance agencies. In addition, the system must balance the policy makers’ concerns for fast disbursement with the public’s and donors’ needs for transparency and accountability.

|

|

More info & Case Studies |

To make sound financial decisions you need to have the right information. Financial analysis of risk data and quantitative evidence empowers governments to take risk-informed decisions on their financial protection against disasters.

|

|

More info & Case Studies |

The Disaster Risk Finance (DRF) aims to strengthen the financial management of disaster risk by providing quantitative financial and economic information & tools for decision-making.

|

|

More info & Case Studies |

While risk financing cuts across different government agendas, successful disaster risk financing and insurance measures are almost always anchored in and driven by the country’s ministry of finance. In a growing number of developing countries, the ministry of finance is adopting integrated approaches to risk management, including against natural hazards. For example through fiscal risk management divisions tasked with identification, quantification, disclosure, and management of fiscal risks, including those associated with natural disaster. Anchoring financial protection to disasters within the ministry of finance also supports comprehensive approaches to fiscal and debt risk management, and allows governments’ to build on existing capacity in managing other contingent liabilities such as debt.

Even where dedicated risk management teams are not in place, the ministry of finance is typically best placed, and benefits the most from, implementing disaster risk financing. In this case other units such as those dealing with budget management, asset and liability management, debt management, economic policy, or sometimes insurance divisions or insurance supervisors can make sensible homes for the agenda. The private sector plays an essential role in the ongoing development of, and access to, disaster risk financing and insurance solutions. It does this primarily by providing capital and technical expertise, and by driving innovation. The private sector also plays a crucial role through public-private partnerships in insurance programs, for example in the delivery of payouts to beneficiaries as well as in the education of consumers.

| More info & Case Studies |

|