When record floods inundated large swaths of Thailand, including its capital Bangkok, in the fall of 2011, total damage and loss amounted to THB 1.43 trillion (US$46.5 billion), more than 13 percent of that year’s gross domestic product (GDP). But the financial impact on the government continued long after the water finally receded.The floods were estimated to reduce real GDP growth in 2011 by 1.1 percent from pre-flood projections, reduced Thailand’s current account to US$11.9 billion from a projected $20.6 billion, and caused a 3.7 percent loss in tax revenue from estimated pre-flood revenues (World Bank and Government of Thailand 2012).

Financial losses from natural disasters continue to rise, with developing countries and their low income population feeling the greatest effects.

Direct financial loss reached an average of $165billion per year during the last 10 years, with loss exceeding $100 billion in six of those years.

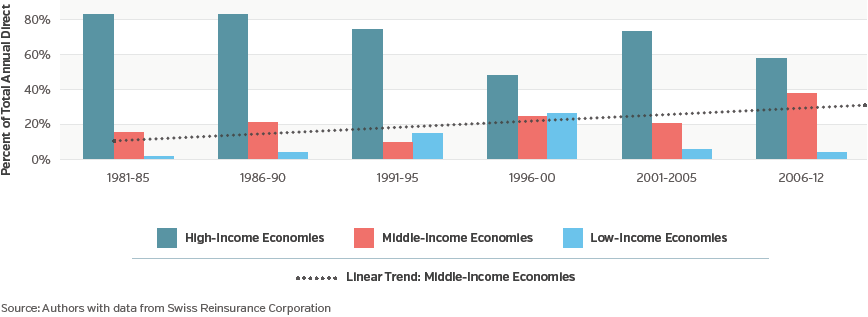

The trends in losses hide a wide range of impact. The relative share of this loss occurring in middle-income countries has seen a steady upward trend over the past 30 years (in 2012 U.S. dollar).

The rapid growth of assets exposed to hazards in middle-income countries—for example through urbanization and new infrastructure—is likely responsible for much of this increase.

As a percentage of GDP, fast-growing middle-income countries suffer the most, with average annual direct loss at 2.9 percent of GDP, followed by low-income countries (1.3 percent of GDP) and high-income countries (0.8 percent of GDP) (Munich Re 2013).

Although average direct loss relative to GDP is less for low-income countries, this does not consider the most important impact—the loss of lives, livelihoods and negative effects on human capital.

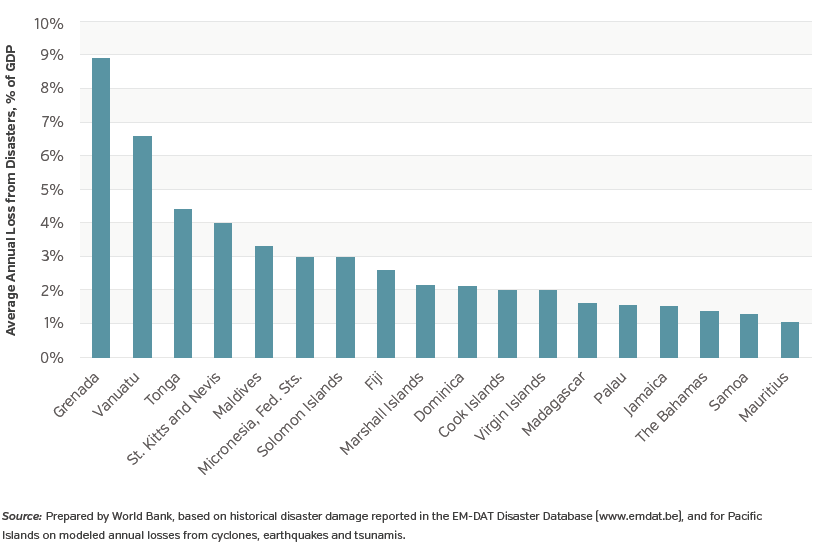

Small island states across the Caribbean and Pacific bear average losses exceeding over 3 percent of their respective GDP every year (World Bank and United Nations 2010; Pacific Catastrophe Risk Assessment and Financing Initiative [PCRAFI] 2011).

In mitigating the financial impact of disasters, experience shows that policy makers are primarily concerned with its effect on the government, homeowners and small and medium-sized enterprises (SMEs), farmers, and the poorest. This segmentation is largely the result of the type of cost associated with a disaster—for example, both homeowners and SMEs are concerned with building damage. Natural disasters directly and indirectly affect the financial and developmental stability of these groups. These are then discussed in turn.

Direct

|

|

More info & Case Studies |

Indirect

|

|

More info & Case Studies |

Direct

|

|

More info & Case Studies |

Indirect

|

|

More info & Case Studies |

Direct

|

|

More info & Case Studies |

Indirect

|

|

More info & Case Studies |

Direct

Indirect

|

|

More info & Case Studies |