Why should the government invest in risk market infrastructure?(And what does that mean anyway?)

Risk market infrastructure is the public goods and institutions to align incentives of the private sector with those of the beneficiary. Specifically this requires building or improving systems for collection, auditing, financing, and managing data; product distribution, underwriting, and portfolio and claims management; as well as adapting the country’s legal and regulatory framework to support catastrophe risk insurance markets. Public investment in this infrastructure can lower the cost of insurance for beneficiaries, enable the development of insurance markets, and encourage demand while avoiding the possible disadvantages and sustainability issues that direct premium subsidies can create. Often, government already possesses such data, but it is not accessible for the purpose of developing insurance solutions.

High quality data 1 is indispensable for developing insurance markets, as it forms the basis for effective and sustainable insurance solutions for all segments of society. Agricultural insurance products for low-income farmers or herders, for example, are usually built on indices that use agricultural or climatic data.2 Only an index that accurately reflects conditions experienced by the farmer is likely to provide cost-effective, reliable protection with low basis risk (see also next question on index insurance). Policy makers play an important role in establishing a framework for data collection, auditing,3 financing, and management, as well as equal access to this data by all market participants.

For example, the government can support investments in audited area average yield data—average crop yield in a given area, controlled for quality and accuracy, that indicates harvest size—enabling the construction of indexes that reliably protect farmers. Reliable data auditing and data management are also necessary for governments if they hope to access international reinsurance markets, which require a high standard of data to develop and price insurance products. If these companies have concerns about how the data is audited, they will charge significantly higher premiums.

An enabling legal and regulatory framework for insurance market development is also crucial. Policy makers need to decide on the legal foundation for catastrophe risk insurance products and determine the capital and reinsurance requirements for insurance companies underwriting the risk. For example, the World Bank Global Index Insurance Facility assisted the Conférence Interafricaine des Marchés d'Assurances—the regional body of the insurance industry for 14 countries in francophone Africa—in drafting amendments to their current regulation to allow for micro-insurance, including agricultural index insurance. This has been ratified by all 14 ministers of finance.

Banking regulations may also be relevant, since linking agriculture insurance to loans to the rural sector is often an effective way of achieving large scale outreach of agriculture insurance. In India, for example, all loans to the rural sector must be accompanied with insurance. This protects rural banks against agricultural shocks; protects the farmer through insurance; and can increase rural lending, leading to increased productivity.

1. From an insurance perspective, data is high quality if it is reliable (so that it properly reflects the actual loss), timely (so that claims can be paid quickly), relevant (so the product offers reliable protection), audited to international reinsurance standards, and cost-effective.

2. Farm-level multiple peril crop insurance is generally not feasible for small farmers and herders as the low sums insured and high cost of auditing data make the schemes uneconomic. Index insurance, on the other hand, has the advantage of being typically cheaper to deliver, but the quality of the index insurance product depends significantly on the quality of the index, which in turn depends on the quality of the underlying data.

3. Data auditing is the process of controlling data quality and assessing how the data is fit for the given purpose.

What is index insurance and should I consider it?

Unlike traditional insurance indemnity-based products that requires the assessment of individual losses following an insurable event, index-based (including parametric) insurance policies make payouts based on a predetermined trigger, such as crop yield estimates, in a given geographical area. Other triggers could be based on the location or intensity of a natural hazard, such as wind speed, rainfall levels, or ground acceleration from earthquakes. The particular index used can be tailored to the availability of data, such as using a parametric index when only hazard data are available (which pays out on a given hazard event), but using a modeled loss index when exposure data are available (which pays out in line with loss modelled using actual exposure data and the parameters such as wind speed from the actual event). Parametric coverage demands improved accuracy of hazard risk data collection systems because of the heavy reliance on objective measurement of weather and hazard parameters.

Index insurance offers several advantages in relation to traditional or indemnity insurance, such as quicker payouts, lower administrative costs, and reduced moral hazard and adverse selection4. For example, at the micro-level it allows domestic insurance companies to offer simple and transparent solutions to farmers to transfer weather risks such as drought, excess rainfall, or low temperatures.

But index insurance is not without its challenges. In particular basis risk, implicit in all index insurance, is the risk that the index measurement will not match individual losses. For example, an insured individual or asset may experience a loss from a disaster that does not reach the threshold of the set trigger and hence does not lead to a payout. Alternatively, a payout could be triggered without any damage and losses incurred. Improved accuracy of hazard data collection systems, increased openness and centralization of historical data, and better quality risk assessments could reduce basis risks, enabling a more efficient and effective use of parametric insurance. For any government it is crucial to understand basis risk given the proposed insurance options, and to carry out a cost-benefit analysis of different potential indexes with different levels of basis risk.

4. Moral hazard means that an insured party is less likely to invest in risk reduction because loss will be borne by the insurance company. Adverse selection means that only people at with the highest risk will buy insurance products, eventually rendering the market unsustainable.

What role do premium subsidies play in disaster risk financing and insurance?

Achieving scale is fundamental to the sustainability of insurance programs at the country level, as this enables costs to be spread among numerous policyholders. Government policies play an important role in increasing outreach and achieving this scale and can reduce the cost paid for insurance by beneficiaries in many different ways. As governments make policy decisions, they should limit public subsidy programs to those that minimize distortions of market price signals and keep in mind that premium subsidies are not always economically efficient.

Often practitioners focus on public subsidy programs as a way of making insurance more affordable and achieving scale. There are, however, several disadvantages to providing direct premium subsidies. For example, they can lead policyholders to underinvest in risk reduction activities—such as irrigation or diversifying crops—or to investing in nonviable crops as they are insured against crop failure. In addition, subsidies by the government are often not sufficiently targeted to reach the poorest in society and once put in place they are politically very difficult to phase out. Direct subsidies, however, could be justified as part of a social safety net program, where the government uses the insurance industry as a delivery system to distribute financial assistance to households in need. Rather than, or in addition to, providing direct premium subsidies, governments or donors can invest in overcoming market inefficiencies that in developing countries often cause underinvestment by insurance companies.

For example, the government could provide subsidies by paying for risk-related data; acting as a reinsurer of last resort; or enforce or encourage the buying of insurance. For instance, many large-scale agricultural insurance programs in low- and middle-income countries, such as in India or China, have achieved scale in part due to insurance being bundled with agricultural credit on a compulsory basis. Turkey’s national catastrophe risk insurance program, which currently protects over six million households, achieved scale in part due to coverage being compulsory for homeowners.

The government of India significantly subsidizes the cost of providing data to the country’s private agriculture insurance market. Similarly, the government of Mongolia pays for the collection of all data used in its Index-Based Livestock Insurance Scheme and provides it to accredited insurance companies. It also provides a fully-financed social safety net to all farmers at no additional cost that kicks in when major losses exhaust insurance payouts. In addition, government extension workers provide education to herders about livestock insurance and how it can complement holistic herd risk management.

How can catastrophe risk pools benefit a disaster risk financing and insurance program?

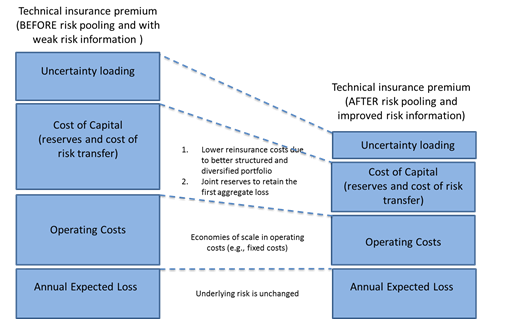

By aggregating risk into larger, more diversified portfolios, catastrophe risk pooling at the national or regional level between countries can reduce the cost of accessing international insurance markets. Pooling risks generates diversification benefits that are reflected in reduced insurance premiums (see Figure 15 which illustrates a total premium and its components before and after risk pooling).

The graph presents how insurance premiums benefit from risk pooling and improved risk data.

Source: World Bank-GFDRR Disaster Risk Financing and Insurance Program

In addition to aggregation and scale, catastrophe risk pooling can accumulate financial reserves over time, allowing participants to self-insure or cover the first loss from these funds. By increasing risk retention—which reduces the probability of an insurance payout—participants can achieve a further reduction in insurance premiums (Cummins and Mahul, 2009).

The Pacific Catastrophe Risk Insurance Pilot, launched in 2013, illustrates how risk pooling can reduce premium costs. Country policies were placed on the international reinsurance market as a single, diversified portfolio, significantly reducing the cost of catastrophe coverage compared to the cost of individual governments maintaining reserves or independently purchasing insurance. The six participating Pacific island countries have obtained an estimated 50 percent reduction in premium payments compared to what they would pay if buying the same coverage individually.