[Event recap] InsuResilience Annual Forum 2023: Introduction to the Global Shield Financing Vehicles

As the effects of climate change continue to mount, the introduction of the Global Shield against Climate Risks offers a beacon of hope. This joint initiative between the V20 and G7 aims to provide more systematic, coherent, and sustained financial protection to climate-vulnerable countries. It leverages the success of tried and tested financial instruments within the InsuResilience Global Partnership. The recently concluded InsuResilience Annual Forum 2023, held in Bonn, Germany, on June 9, 2023, brought together the broader resilience community, fostering collaborative efforts towards advancing Climate and Disaster Risk Finance and Insurance.

As part of the Forum, participants had the opportunity to gain key insights into the Global Shield’s financing structure and its three vehicles: The Global Shield Financing Facility, the Global Shield Solutions Platform and the CVF & V20 Joint Multi-Donor Fund. The “Introduction to the Global Shield Financing Vehicles” session featured representatives of the financing vehicles, who sought to provide a better understanding of how each of the vehicles works and complements the others to achieve more coherent, systematic and sustained financial protection in vulnerable countries.

Daniel Stadtmüller (Team Lead, InsuResilience Secretariat), who acted as moderator, opened the session, highlighting how there is currently a lack of clarity among countries in terms of what type of support is available and from whom, as well as how this support can be tied into one coherent system of financial protection, in alignment with national priorities and the needs of vulnerable people. This was followed by three short presentations that focused on the mandates, approaches and instruments, as well as the decision process behind how country requests are channelled to the different financing vehicles and how solutions packages would be designed in response.

Annette Detken (Head of the Global Shield Solutions Platform [GSSP]) and Karsten Löffler (Co-Head of the GSSP) provided an overview of the GSSP. They elaborated on the three elements that the financing vehicle leverages: i) education and research; ii) concept and solutions development; and iii) implementation. Annette and Karsten also stressed on the importance of gender and social inclusion, and the need to take an inclusive and modular competitive approach to climate risk financing.

The next presentation, helmed by Simon Hagemann (Financial Sector Specialist, World Bank) and Kaavya Ashok Krishna (Senior Financial Sector Specialist, World Bank), focused on the Global Shield Financing Facility (GSFF). This financing vehicle builds on the Global Risk Financing Facility’s strong track record of project implementation, and aims to support poor and vulnerable countries and people with increased access to financial protection against climate shocks, disasters, and crises. The GSFF achieves this through technical advisory services and integrated financial packages to address protection gaps, as well as by building strategic partnerships. The GSFF is structured around four pillars, and Simon explained how it will strengthen technical partnerships and program financial protection packages through World Bank country engagements. Further, he listed the types of financial instruments that the GSFF can support, such as: Sovereign risk transfer, Catastrophe bonds, Risk pools, Partial credit guarantee schemes, Adaptive social protection, and Contingency funds. Kaavya wrapped up the presentation with a case study on the DRIVE project in the Horn of Africa, featuring key results, and a quick summary of the capacity building activities that are part of the GSFF.

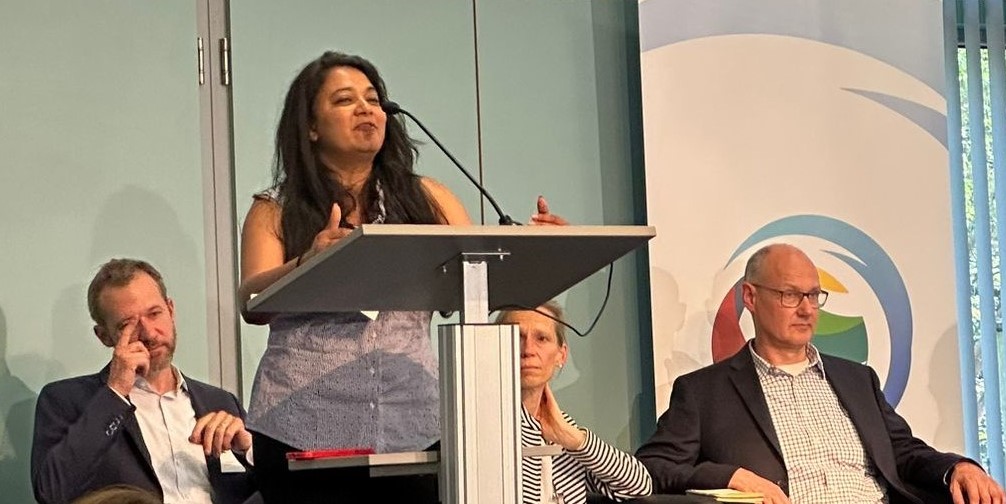

The final presentation was by Gurel Gurkan (Head of Programme, United Nations Office for Project Services [UNOPS]) and Sara Jane Ahmed (Finance Advisor, V20 Secretariat), who introduced participants to the Global Shield CVF-V20 Joint Multi-donor Fund. They provided an overview of the financing vehicle, its goals, structure, funding sources, and priorities, while also highlighting the need to constantly innovate. Wrapping up their presentation, Gurel and Sara stressed on the importance of climate-vulnerable countries committing to being actively involved in the solution-building process.

The presentations were followed by an insightful Q&A session, which dealt with the following:

- The distinct advantages offered by each financing vehicle, and its features.

- How the different financing vehicles will work together to provide clients with the best financial solutions. The panellists explained how the platforms will collaborate and integrate their services to offer a comprehensive suite of options.

- The frameworks and methodologies that are currently in place to assist countries or clients in selecting the most suitable financing vehicle for their specific requirements.

For more information on the Global Shield Financing Facility, please contact: GSFF_Secretariat@worldbankgroup.org