Expect the Unexpected: Three Benefits of Rainy Day Funds

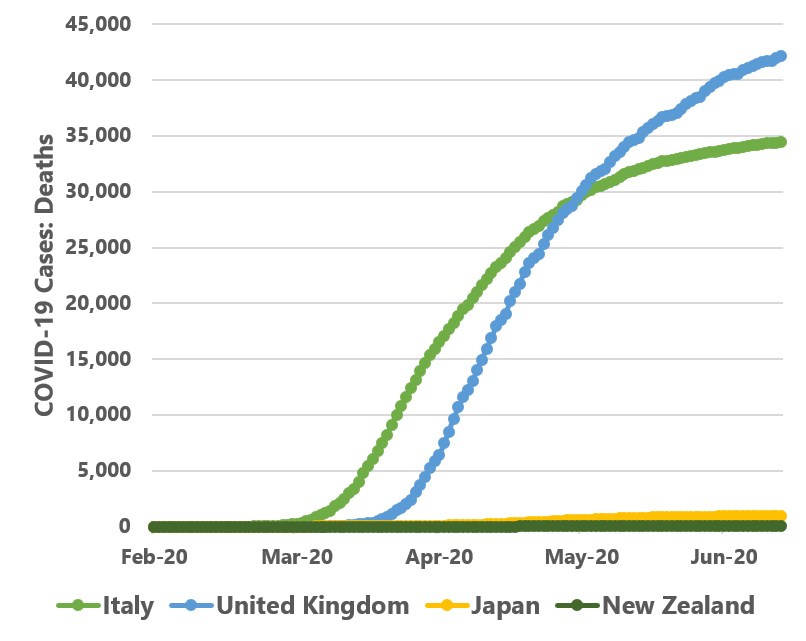

Simply put, we save money as a precaution because we do not know what the future holds. Savings help governments fulfill their fundamental role, which is to ensure the well-being of their citizens. When natural disasters or crises strike, early action saves lives. COVID-19, which has wreaked havoc on economies and taken the lives of people around the world, has proved this yet again. Statistically speaking, COVID-19 has shown that timely action helps flatten the curve (see figure 1).

Figure 1. COVID-19 Deaths in Italy and United Kingdom versus those in New Zealand and Japan.

Source: Data from Johns Hopkins University Center for Systems Science and Engineering, https://data.humdata.org/dataset/novel-coronavirus-2019-ncov-cases

The current pandemic was not unpredictable. Since the 1918 Spanish influenza, scientists have talked about the possibility of another pandemic. Among many voices, in 2003 the Organisation for Economic Co-operation and Development warned that another pandemic was not only possible but imminent. With COVID-19, we are learning just how costly those events can be (through their triple health, economic, and financial impact).

The future development of the pandemic is uncertain. Models of the virus’s spread propose different outcomes as they are subject to assumptions. For instance, it is unclear if we should expect second, third, and fourth waves of infection like those seen during the Spanish influenza. Or will typhoons or earthquakes hit us tomorrow? In any scenario, it is our duty as humans to act—and to act quickly.

Photo Credit: World Bank Group. Sichuan Province after the 2008 earthquake. China.

Governments cannot act quickly without financial resources. A recent World Bank blog by Alfonso Garcia-Mora and Olivier Mahul stressed prearranged funding as a key enabler of rapid and effective response. Less-advanced economies might struggle with securing such funding because their economic well-being often compares to their capacity to raise revenues.

In India, the government of Kerala showed that effective containment measures are possible through preparedness. The government had access to rainy day funds, which allowed for the quick release of money to support a well-designed disaster (or pandemic) response plan. In fact, Kerala had been preparing for the next catastrophe since the 2018 floods that revealed how important it is to build resilience.

For governments, savings have an opportunity cost of those monies not invested elsewhere. So why would a government want to save funds for a rainy day? Some key reasons are as follows:

1. Be prepared. Though it would be great to know when and where we will need cash in the future, we have no such certainty. We do not know how COVID-19 will develop or when the next disaster will strike. Nor do we know how many regions or people a disaster will affect—but we know something will happen. Considerations such as how much money we will need immediately or how we will spend it, and on what, make regular budget planning a challenge. Saving for a rainy day can help manage this uncertainty.

Like many countries, Albania has a reserve fund. In the beginning of 2020, the government tapped into half its reserves to support immediate containment and lockdown measures in response to COVID-19. It then doubled the fund and, soon after, increased the reserves by almost eight times the initial amount of the fund. This change was most likely done to reflect how little we know about COVID-19 and how quickly measures must be implemented to contain its spread (while still being prepared for other unexpected events).

2. Act early. Early action helps reduce the negative impacts of disasters and crises. However, governments’ resources are depleted day by day and an absence of savings may worsen any crisis. Countries across the world are eating into their fiscal reserves, reallocating budgets, and borrowing, thereby worsening their debts. Revenues fall as people lose salaries, businesses lose earning, and economies slow down. Setting money aside in a rainy day fund will help governments to have the means to act early.

Many countries are searching for rapid funding to respond to COVID-19. For instance, the World Bank’s Catastrophe Deferred Drawdown Option (Cat DDO)—a contingent credit available to governments—was triggered in nine countries soon after the world realized just how far-reaching the impacts of the pandemic could be.

Photo Credit: World Bank Group. COVID-19 testing in Madagascar.

3. Respond. A reactive approach is expensive and can cost lives. It is often said that it is easier to prevent than curing a disease. Preparing in advance requires thinking about how to manage financial costs before those costs materialize. Rainy day funds have been used for centuries as a source of quick liquidity. In the time of COVID-19, they could secure the capacity to buy health equipment and medical supplies, support containment measures, or provide food for the needy.

Rainy day funds, however, are not an all-in-one solution to cover any cost of a crisis or disaster. A risk-layering approach, which combines different sources of funds to ensure cost-effectiveness, is important. Though it might be too late to buy insurance for COVID-19 (unlike those who have already done so, such as the Wimbledon tennis tournament), we can decide how to transfer future pandemic and disaster risk, access capital markets, put contingent credit in place, and effectively mobilize donor aid.

Rainy day funds are well known, but a word of caution is that such funds must be carefully designed. This design includes consideration and scrutiny over such aspects as governance and oversight, disbursement rules, and funding sources. Maintaining transparency and efficiency in a time of such an unprecedented volume of emergency spending will help generate trust among taxpayers and donors.

As we grieve for those who have lost their lives to COVID-19, we have an important strategic decision to make about what we can do better amid the current crisis, and how we can prepare for the next one. This requires acting now on financial preparedness.

The structure of financial preparedness matters less, be it a rainy day fund, a Cat DDO, a contingent emergency response component, a Pandemic Emergency Financing Facility, or even a risk-sharing facility for the private sector. What matters more is that we have funding ready to act early.

Photo Credit: United Nations. Streets and pathways are flooded after the passing of Hurricane Tomas in Gonaives, north of Port-au-Prince, Haiti.

To view this blog in a MailChimp setting, click here.

Disaster Risk Finance | COVID-19 Blog Series

- Five Lessons on Disaster Risk Finance to Inform COVID-19 Crisis Response

- Five Reasons You Should Be Thinking About Compounding Risks Now

- Five Reasons the Global Risk Financing Facility Is Relevant During an Ongoing Pandemic

- Five Ways COVID-19 Leads to Natural Catastrophe Protection Gaps at the Sovereign Level

- Expect the Unexpected: Three Benefits of Rainy Day Funds

- Five Ways the World Bank’s IDA-19 Is Supporting the Poorest Countries in the Time of COVID

- Three Ways That Contingent Policy Financing Contributes to Resilience Building Before, During, and After COVID-19

- Five Reasons to Support SMEs So They Can Build Stronger Resilience to Future Disaster Shocks

- Three Reasons the Public and Private Sectors Are Stronger Together Against Disasters and Crises

- Five Ways Satellite Data Can Help Prepare for the Unexpected

- Four Ways Disaster Risk Finance Strengthens the Effectiveness of Adaptive Social Protection

- Three Ways to Enhance Online Knowledge Exchange During the COVID-19 Pandemic