Disaster Risk Finance

This section considers the cost of providing timely financing for ex ante response and lays out how well-structured risk finance strategies can reduce the economic costs of managing fiscal volatility. Three papers develop and then apply a methodology to quantify the costs of different combinations of budgetary and financial instruments that can be used to finance a disaster response. The approach results in a simple formula to capture the opportunity cost of risk finance strategies and to help decision makers choose the least-cost approach. But can choosing the right combination of financial instruments markedly impact the cost of a more timely response?

In a worked example of scalable social protection in Ethiopia, the authors find that an alternative disaster risk finance strategy could reduce the average cost of financing scalability expenditures by 25 percent. Applying a macroeconomic model to Jamaica, shows that reallocating budget expenditure on operations and maintenance to finance more timely reconstruction was three times more expensive than insurance, which was in turn slightly more expensive than raising taxes.The final paper explains catastrophe risk models and applies them to designing, implementing, and monitoring disaster risk finance strategies that guarantee that disaster risk analytics are based on sound physical science.

Ministries of Finance of disaster-prone countries, along with donor partners who are also facing rising costs from disasters, are increasingly asking such questions as:

These questions, and others about how to decide on the details of disaster risk finance strategies, have been difficult to answer, in part because of the lack of a robust methodology that allows a full range of budgetary and financial instruments to be compared side by side in a consistent, comprehensive way. This methodological limitation has meant that strategies may be chosen and implemented without systematic analysis of whether the programs and financial strategies being employed are appropriate and cost-effective, bearing in mind the risks faced.

To begin to solve the problem of this analytical gap, Clarke et al. (2016) develop a robust, comprehensive methodology to allow quantitative analysis of the full economic cost of these financial instruments. The methodology builds on insights from actuarial science and financial economics to divide the problem in a way that makes ex ante evaluation of the financing side of the problem possible.

Specifically, the paper considers the case in which a government has chosen a set of fixed responses for possible future disasters and wishes to understand the costs and benefits of financing these responses through various combinations of financing instruments (see figure).

The framework is flexible enough to be useful for decision makers concerned with different aspects of disaster. For example, it could be used to calculate the long-run average cost or the cost for specific potential extreme disasters.

Clarke, Cooney, Edwards, and Jinks (2016) apply the framework developed in Clarke, Mahul, Poulter, and Teh (2016) to five practical case studies, and present a guidance note on how the framework can be applied in practice. In doing so, they illustrate the flexibility of the framework and its ability to be used by governments to systematically determine whether their financial strategies are appropriate and cost-effective in view of the risks they face.

Application of the framework to the five anonymized, simplified, real-world countries involves the following steps:

The report does not make any generalized conclusions about which instruments or strategies are cheapest. Instead, for each country, results and sensitivities are presented. The most cost-effective strategy for each case study depends on the risk tolerance of the relevant policy makers.

Rural safety nets in low-income countries remain a challenge to develop, yet the Government of Ethiopia has developed and implemented the Productive Safety Net Programme (PSNP), providing nearly 8 million Ethiopians with the means to work their way out of chronic poverty.

Clarke, Coll-Black, Cooney, and Edwards (2016) adapt the framework of Clarke, Mahul, Poulter, and Teh (2016) to comparatively analyze potential risk finance structures that support drought response through the PSNP. They define a hypothetical version of the PSNP in which woredas (districts) receive automatic financing based on an early warning system that is tied to a water deficit index. Under these hypothetical "rules," the PSNP scale-up supports annually, on average, 2.9 million transitory poor, requiring an average expenditure of US$139 million per year.

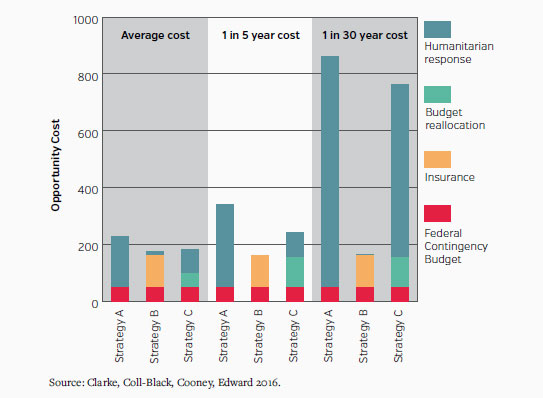

Three primary hypothetical risk strategies are then considered to finance these expenditures. The initial instrument in all strategies is the federal contingency budget (FCB), which must be exhausted before other instruments can be applied. Unlimited humanitarian response is always assumed to be a last resort. The base case, strategy A, includes the FCB and humanitarian response only; strategies B and C consider a layer of insurance and budget reallocation, respectively, between the two (see figure).

Under the best estimate assumptions, the average cost of financing the US$139 million average liability (average of 2.9 million additional beneficiaries) ranges from US$175 to $230 million.

Both the FCB and budget reallocation are depleted in a significant proportion of the 5,000 simulated scenarios. Because of the assumed layer of insurance available and the relatively low pricing multiple (1.35 compared with an opportunity cost of 2.0 applied to the humanitarian response), strategy B is the cheapest on average. As the figure shows, the cost savings of insurance also rises for more severe droughts; the results of the costs of a one-in-5-year and a one-in-30-year event demonstrate this clearly.

Finally, the paper highlights the fact that financial cost is only one component of the risk financing decision, and that other aspects need to be considered for any practical recommendation.

Using a macroeconomic model, Bevan and Adam (2016) simulate the effects of alternative post-disaster financing mechanisms when increased foreign borrowing is impractical. They examine sovereign disaster risk insurance, increased taxation, and budget reallocation as alternative financing mechanisms for rebuilding public capital. The model measures costs and benefits in terms of real household consumption and decomposes the expected net cost of the public finance responses into gross benefits from the rebuilding of the public capital stock and the gross cost of mobilizing the required fiscal resources (that is, the opportunity cost).

Although their model can be adjusted to fit various financing and disaster scenarios, they use the risk profile and national accounts data from Jamaica as an example and simulate a number of possible outcomes for a cyclone disaster. In addition to doing nothing, the government has three choices: (1) to take out full insurance with premiums financed from taxation; (2) to reallocate public expenditure away from recurrent operations and maintenance expenditures; or (3) to raise taxes. Their calculations estimate the internal rate of return of faster reconstruction to be in the range of 11—17 percent. The opportunity cost of funds is more variable, depending on the financing choice. For the tax financing regime, the opportunity costs are lowest, at 6—9 percent, measured on an internal rate of return basis. Reallocations away from operations and maintenance, by contrast, result in an opportunity cost as high as 37—44 percent. For insurance, the equivalent numbers fall in the range of 12—15 percent, higher than the tax alternative, but much lower than the reallocation. Overall, direct tax financing appears to be the most attractive option. Yet it requires that raising taxes be a feasible option. In the chosen model application, taxfinanced reconstruction would require a tax increase of 1.5—2 percent over a full decade. The researchers propose that for high-damage rare events insurance could be a better choice because of the faster pace of reconstruction. In any case, budget reallocation is associated with the most costly and substantially slower recovery in all scenarios. These results span a limited range of financing options, and it is straightforward to extend the analysis to examine "blended" financing packages, including ones incorporating debt financing.

This methodology does not adequately capture some aspects of disaster risk finance that merit further research. First, this analysis assumes that the risk transfer products perfectly match the government's expenditure rules. It would be useful to extend the analysis to accommodate the case in which payments from risk transfer instruments do not synchronize with expenditures. Second, many of the assumptions required for practical implementation of this methodology, such as the opportunity cost of budget reallocations or the cost of delayed response, are based on limited evidence. The analysis would benefit from further work addressing these empirical limitations. Finally, this paper addresses only responses to the destruction of public capital. A natural extension would be to incorporate the loss and reconstruction of private capital.

Ley-Borrás and Fox (2015) provide an overview of how catastrophe (cat) risk models can be used to appraise disaster risk finance strategies and identify the impacts of natural disasters on the poor and vulnerable. Probabilistic cat risk models typically comprise four modules:

Probabilistic cat risk models usually contain tens of thousands of event scenarios. As a result, the model produces more risk estimates (magnitudes) for rarely occurring natural disasters than can be found in the historical records. Cat risk models also provide probabilistic estimates of costs and consequences—key inputs for any formal decision-making process on disaster risk finance instruments.

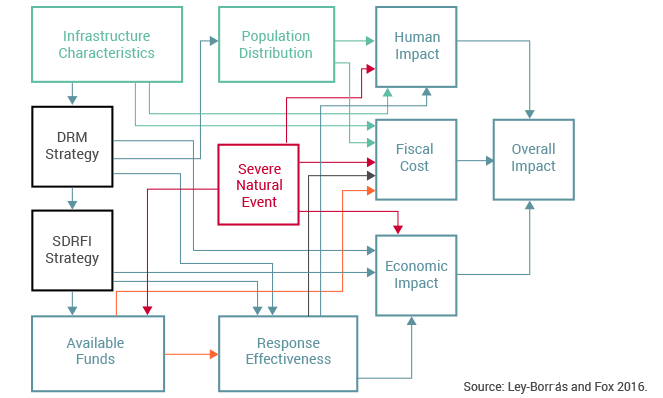

Influence diagrams showing the relationships among decisions, uncertain events, and consequences—support the linked decision making of disaster risk management and disaster risk finance instruments (see figure). Such diagrams can provide insights and are valuable in gaining consensus and buy-in.

Strategy generation tables can help anyone seeking to design a small number of coherent, effective, and affordable strategies. The tool is easy to use and can be scaled to the desired level of detail, with the type of financial instrument heading the columns and the specific alternatives in the body of the table.

Integral decision analysis brings all of the interested parties to the process, helps them understand the pros and cons, and moves the parties forward in unison through climatic events. Four valuable steps are: (1) define the scope, (2) structure the objectives, (3) generate alternatives and strategies, and (4) identify and measure uncertain (including manmade) events.

In concluding, Ley-Borrás and Fox provide eight suggestions to build catastrophe risk models that facilitate decisions on sovereign disaster risk finance.